How can AI and IPA benefit the non-banking financial companies (NBFCs)

Over the past few years, the Financial Services (FS) sector has witnessed a reduction in expenditure required for carrying out processes related to customer transactions. As more information is exchanged between channels, new data keeps accumulating.

Even with the adoption of new digital technologies, many non-banking financial institutions struggled to cope with this shift while they continue using conventional methods for driving daily operations.

However, the rise of Artificial Intelligence based solutions started making a huge difference in this field by bringing process automation into daily operations, despite the continued use of legacy systems. This soon led to FS organizations using several AI-based technologies together in the form of Intelligent Process Automation (IPA). Intelligent Process Automation is a revolutionary way that can streamline operational processes, provide personalized customer service experience, and boost overall business performance in the Financial Services industry.

This blog talks about how financial institutions, particularly in the non-banking sector, are using IPA to empower their business operations as cutting-edge technology.

How IPA for non-banking financial companies works

Many of the incoming customer inquiries and internal documents that require processing comprise unstructured data. Thus, it becomes tedious for conventional automation techniques to accurately process this data, which affects task efficiency.

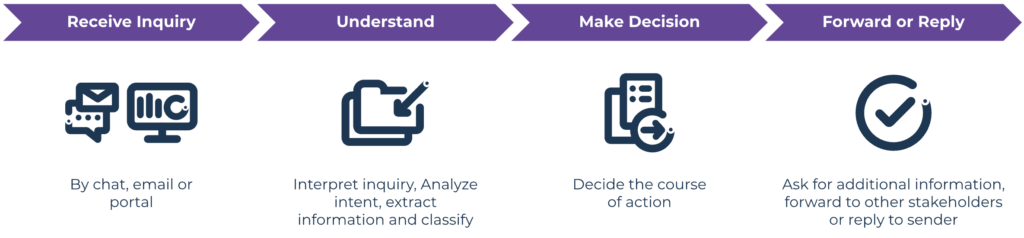

An Intelligent Process Automation solution has the capability to understand and analyze structured as well as unstructured data or free-text. In terms of its working process, a generic IPA solution receives a customer inquiry through channels such as emails, documents, and chats. Using robust Natural Language Engines, the AI that powers this solution reads and interprets the data received, analyses it, and extracts relevant information based on analysis and interpretation.

With pre-set business rules, it uses the extracted information to undertake certain decisions with the help of a Decision Engine. These decisions are finally linked to key actions that businesses using these IPA solutions want to carry out – for example, replying and forwarding, archiving, moving to specific folders, classification, and more.

IPA benefits

- Streamlines customer journey by providing end-to-end automation

- Frees up time for employees by tackling repetitive tasks

- Improved workflow accuracy and reduces the risk of errors

- Processes large volume of emails and documents in a matter of minutes

Work areas in the NBFCs where IPA can make a difference

Customer engagement and support

IPA can be used for improving customer service by reducing customer response times, higher speed of resolving customer inquiries, and providing easy and instant access to the information requested by customers. This requires the digitization of platforms that traditionally handle repetitive processes such as payment platforms, customer inquiry portals, and chat modules. With respect to operational purposes, IPA for enhanced customer experience usually entails providing virtual Financial Services branches that incorporate different IPA technologies and act as 24/7 customer support centers.

Debt collection

Intelligent Process Automation plays a valuable role in this domain by providing the opportunity for associated organizations to reduce the time taken for manual handling of repetitive debt collection activities. This is possible by integrating IPA through automated payment processing mechanisms, online digital assistants, and automated invoice management systems that can optimize the workload and free-up more time for value-added tasks. These IPA solutions can validate customer documents and gather relevant data, receive and acknowledge debtor inquiries related to outstanding debts, postponements, objections, etc., take actions as per the case in hand, and archive relevant information for future use.

Accountancy

IPA in accountancy mainly works by reducing the manual effort needed to process payment transactions and address any kind of customer grievances in this domain. With Machine Learning techniques, Intelligent Automation can identify patterns in customer payment activities and provide them with improved experiences to generate better customer satisfaction.

Credit and loan investments

Intelligent Process Automation solutions carry the ability to identify key words or phrases from a complex jumble of paragraphs and data, using Natural Language Processing techniques. This is extremely useful for processing credit and loan-related inquiries and investment applications from customers, wherein the customer support department of FS organizations might require processing large volumes of unstructured data or free-text. Using NLP techniques, the identified data can be further used for extracting relevant information, and then for carrying out actions. Some of the actions are credit applications, issue resolution, loan disbursal, EMI payments, and general credit and loan inquiries, to name a few.

Growth avenues and outcomes

In the coming few years, we can expect to see increased accuracy in matching customer needs in the Financial Services industry with accurate performance indicators that work hand-in-hand with IPA solutions. In terms of outcomes, we could see more of customer and service experience-based strategies used by FS organizations such as customer behavior analyses, quality lead generation, and customer personalization, rather than product-focused techniques that are still practiced. This can certainly help organizations source new clients at a robust pace, and ultimately derive a high return on investments (ROI).

Conclusion

In this digitally advanced world that carries a rising demand for personalized user experience, the need for process automation is now more than ever. Intelligent Automation carries the power to deliver these demands and accelerate growth in task-intensive industries such as Financial Services, and even Banking and Insurance to a huge extent.

In the NBFC industry, Intelligent Process Automation can make a huge difference in work areas such as debt collection, customer engagement, customer experience, accountancy, credit and loan investments, and more. With its ability to process structured as well as unstructured data (free-text), IPA can enable FS businesses to efficiently extract relevant data. This data can then be used to accurately perform required actions such as resolving customer inquiries, processing emails and documents, updating CRM and back-end systems, and managing replies and forwards, to name a few.

About Simplifai

Simplifai is an AI solutions company that provides end-to-end automation for businesses in the Financial Services sector through AI-powered Digital Employee solutions.

Digital Employees for Financial Services are quick to implement, read and interpret structured and unstructured data, and help scale up organizational growth. They can be easily deployed in business functions such as daily banking operations, claims handling, customer service, debt collection, and many more in this industry.

Digital Employees comprise individual modules such as Emailbot, Documentbot, and Chatbot. Together with Natural Language Processing (NLP), decision engine, rules engine, our solutions can be integrated with external, third-party systems with Robotic Process Automation (RPA) and Application Programming Interface (API).

Curious to know how our Digital Employee works? Click the button below: