How Artificial Intelligence is transforming BFSI at a global level?

Artificial intelligence (AI) has made significant inroads in several industries. The Banking, Financial Services, and Insurance (BFSI) sector is no exception. From streamlining processes to providing personalized services, AI in BFSI is helping organizations to improve their operations and better serve their customers. In this blog post, we will look at some of the ways AI is transforming BFSI at a global level.

The BFSI industry is in a tight spot

The key players specifically in the BFSI segment have faced challenges to deploy full scale AI solutions across their operational frameworks. Some common hurdles have a sceptical approach towards AI, lack technological foundation, unorganized data assets, and are dependent on legacy tools that makes internal collaboration more complex. Moreover, fear of opening access to more sensitive data base is also one of the main bottlenecks in AI adoption.

Contrarily, there is also a notable rise in customer expectations linked to digitization has forced businesses to rethink the way they can harness Artificial Intelligence. As we skim away from the pandemic environment now, consumers’ preference for online and mobile-first approach is here to stay long. As per an article by Mckinsey & Co., between 15 and 45 percent of consumers expect to cut back on branch visits following the end of the crisis, across global markets [1].

Digital transformation through AI in BFSI is no longer an option – it is a necessity

With the world going digital, it is important for businesses to stay competitive and relevant to the market needs. In the case of Banking, Finance and Insurance sector, digitizing their operations can improve their efficiencies and open new market avenues in terms of solutions and customer success.

Additionally, AI if applied smartly into the core processes, (e.g. document handling, customer request, and claims processing) can help businesses save costs and drive growth. Thus, this can divert workforce to focus more on productive tasks.

While the benefits of digital transformation are clear, the process can be daunting for businesses. But, with the right planning and execution, businesses can simply automate their operations and reap the benefits of this powerful technologies, thanks to AI.

New AI in BFSI capabilities are not limited to chatbots

BFSI being an industry dealing with an infinite pool of customer base and equivalent complex processes is the perfect use case for AI-powered process automation. Ideal scenarios in any organization that caters to banking, financial services, and insurance are product inquiries, loan applications, claims processing, and many other repetitive and mundane tasks that have been there for decades. And every enterprise has a set of teams that manages and processes these requests manually.

Entry of AI with chatbot made its identity as a proven AI solution. It was the smart tech that reduced human intervention. As a result, organizations shifted to chatbot from email as their prime mode of communication. However, emails have been and always will be a crucial form of communications for business.

So, beyond chatbots, there is an actual requirement to automate repetitive back-end operations of handling email and documents. Moreover, handling these operations manually lead to increased operational and resource costs, are prone to errors, and consume large time durations.

An ideal customer expects a response within one to four hours, while according to a research based on a survey, the average response time to customer emails is 12 hours and 10 minutes [2]. This bottleneck can be easily eliminated, as advancements in AI are phenomenal.

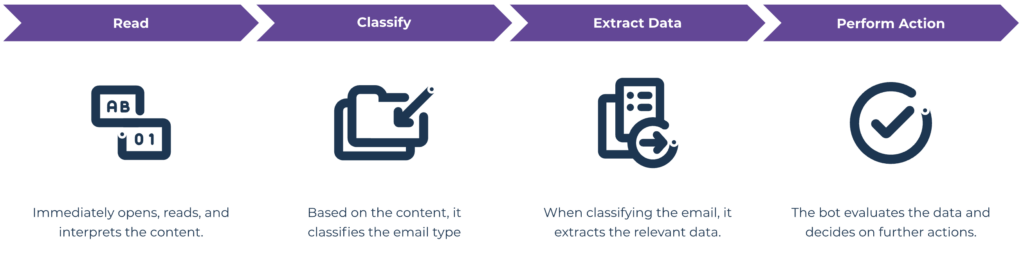

AI for email processing can seamlessly work in your CRM/Back-office systems through easy integrations and can be updated regularly.

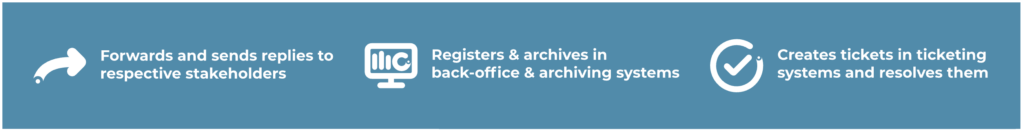

Similarly, for documents processing like receipts, purchase orders, utility bills, invoices, etc., AI can read and interpret content of incoming documents in both structured as well as free-text formats. Using this information, it can then carry out relevant actions such as forwarding and replying, archival, registering case in CRM and back-office systems, creating tickets, and notifying stakeholders.

What can the BFSI sector benefit from AI?

Integrating precise AI-solutions dedicated to process automation can help businesses meet the fast-paced customer demands embracing digitization. Organizations need to step up and automate their processes with innovative technologies like AI and Machine Learning. Harnessing cognitive technologies will help businesses to grow in the long run, as streamlined processes with minimal costs would be highly appreciated and adopted.

It is now time to build impactful business processes backed with powerful combinations of Artificial intelligence and process automation. AI-led tools can fill the gap in the loop of human and machine combination, handling complex email, and documents processing.

About Simplifai

Simplifai is an AI solutions company that provides end-to-end automation for businesses in the BFSI industry through AI-powered Digital Employee solutions.

Digital Employees for BFSI are quick to implement, read and interpret structured and unstructured data, and help scale up organizational growth. They can be easily deployed in business functions such as daily banking operations, claims handling, customer service, debt collection, and many more in this industry.

Digital Employees comprise individual modules such as Emailbot, Documentbot, and Chatbot. Together with Natural Language Processing (NLP), decision engine, rules engine, our solutions can be integrated with external, third-party systems with Robotic Process Automation (RPA) and Application Programming Interface (API).

Curious to know how our Digital Employee works? Click the button below:

Sources

[1] Biswas, S. et. al. AI-bank of the future: Can banks meet the AI challenge? Mckinsey and Co. (Sept 19, 2020), https://www.mckinsey.com/industries/financial-services/our-insights/ai-bank-of-the-future-can-banks-meet-the-ai-challenge

[2] MacDonald, S. 5 ways to reduce customer service response times. SuperOffice, (Feb 11, 2022), https://www.superoffice.com/blog/response-times/