Transforming Insurance with AI: Simplifai’s Innovative Approach

In an era where customer expectations are rising, Simplifai is ushering in a new age of efficiency in the insurance industry. Using advanced our AI solutions – InsuranceGPT, Claims Handling, Customer Service, and Document Handling, we are driving automation, enhancing customer experience, and streamlining operations like never before.

The insurance industry is undergoing profound changes, driven by innovation and the need to meet customer expectations for enhanced experiences. Speed, accuracy, and efficiency have become more critical than ever as the industry evolves rapidly. Despite digital transformation efforts by many insurers, traditional organizations struggle to adapt swiftly to the new technological ecosystems. This is where Artificial Intelligence (AI) steps in, playing a pivotal role in addressing these needs and transforming how insurance companies operate and engage with customers.

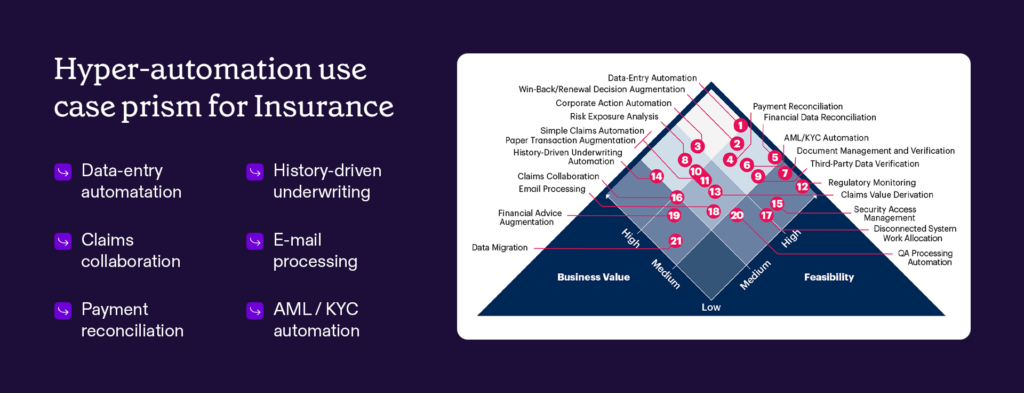

Source: Gartner, Hyperautomation Use-Case Prism for Insurance 2022, Laurie Shotton, Nicole Sturgill, 9 May 2022

At the forefront of this revolution is Simplifai AS offering cutting-edge AI solutions for insurance that set us apart from the competition. Our solutions are designed to automate essential workflows, elevate customer service, and streamline operations, granting a competitive edge in the dynamic insurance market. Discover how Simplifai is transforming insurance operations worldwide with four state-of-the-art AI solutions to drive efficiency, profitability, and scalability in the industry in this latest blog.

1. InsuranceGPT AI Solution

Simplifai InsuranceGPT is a custom-built GPT program, configured on our revolutionary no-code Simplifai AI Automation Platform. It is a first-of-a-kind Software-as-a-Service LLM-trained GPT solution that can help insurance organizations scale up their growth.

With InsuranceGPT, Simplifai has strengthened its end-to-end business process automation capabilities, providing enriched communication between insurers and their customers through the power of generative AI.

Business values delivered:

Performance-oriented – Ensure quick, concise, and accurate responses in line with customer requirements. The InsuranceGPT solution can be configured to match these operational requirements and deliver the desired output.

Vigilant and security compliant – Maintain control of all major laws and regulations to protect customer data. Simplifai is committed to strict control of data privacy and data regulations by adhering to the GDPR and ISO.

Streamline operations without coding – Simplifai no-coding AI Automation Platform allows businesses to seamlessly integrate their third-party and external systems with the Platform without the need for any technical expertise.

2. Claims Handling AI Solution

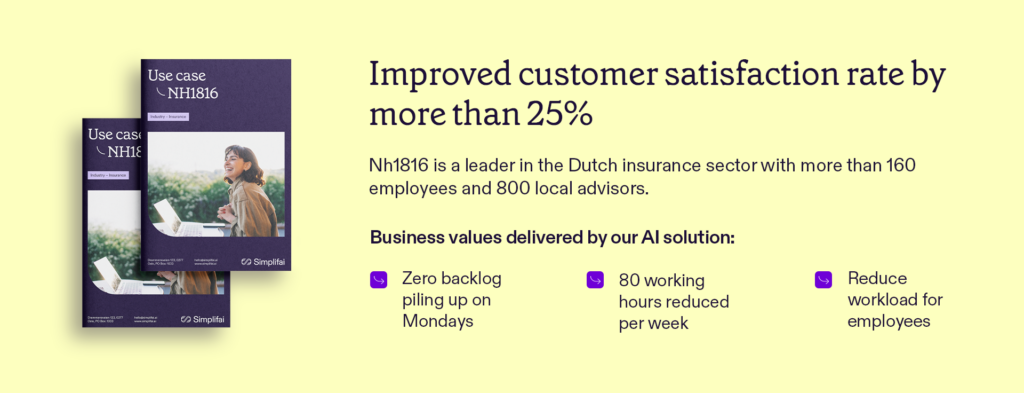

As a complex process, claims handling can be time-consuming and prone to errors, affecting overall work efficiency. Adopting Simplifai’s Claims Handling AI solution provides end-to-end claims processing automation for a faster, simpler, and more satisfying claims journey.

This AI for claims processing can improve the efficiency of processing insurance claims, thus reducing both overpayments and underpayments, with a lasting positive impact on a business’ combined ratio.

Business values delivered:

Improve customer response times – By automating claims processing, our solution speeds up response times and reduces the risk of human error, ensuring accurate claims handling.

Enhanced claims handling – The solution uses AI to interpret the content of claims, making it possible to automate responses and save time, thus freeing up your team to focus on complex tasks.

Improved customer satisfaction – By reducing the daily processing time of claims requests, customers no longer need to wait days or even weeks in the end to access service representatives to resolve claims disputes.

3. Customer Service AI Solution

In today’s digital age, customers expect fast, accurate, and personalized service. Simplifai’s Customer Service AI solution meets these expectations head-on to understand and respond to customer queries, providing accurate responses within seconds.

By automating responses, our solution not only enhances customer satisfaction but also reduces the workload on your customer service team. This allows more focus on more complex queries and improved work efficiency.

Business values delivered:

Improved customer trust and retention – Reduce response time from a few hours to a few seconds, thus meeting today’s customer expectations, ultimately building their trust and improving chances of retention.

Added work capacity – Saving time by resolving customer inquiries in seconds adds more work capacity for the customer service team. This is extremely useful while handling large volumes of customer inquiries during peak seasons and complex cases.

Reduced operational costs – Businesses spend heavily on customer service to deliver optimal customer experience. With our Customer Service AI Solution, businesses can reduce this cost by more than 50% to scale up fast.

4. Document Handling AI Solution

Document handling is a critical yet time-consuming task for insurance companies, especially when carried out manually. It is a prime obstacle for businesses and affects work productivity, increases costs, and gives error-prone output. To overcome this obstacle, Simplifai offers its AI Document Handling Solution to automate the handling of documents for businesses.

This solution uses technologies such as Natural Language Processing (NLP) and Optical Character Recognition (OCR) to classify, process, and interpret the text of each document.

Business values delivered:

Faster processing times – The Document Handling Solution drastically reduces the time and effort required to manage large document volumes, leading to faster turnaround times and overall customer satisfaction.

Focus on complex tasks – The freed-up time can help teams from business functions in both front and back-office areas to dedicate it towards resolving complex tasks, thus increasing productivity and operational efficiency.

Reduced employee burden – With more time and other resources dedicated towards a streamlined approach to document handling and management, our solution can lower employee burden and improves work satisfaction among employees.

Conclusion

Traditional insurance companies often struggle to realize the true value of AI-based business automation solutions due to misconceptions that they are complex, costly, and require extensive effort. However, Simplifai’s AI solutions have proven these misconceptions wrong, demonstrating their significant impact on the industry.

The insurance industry must embrace change and enter a new era of revolutionized processes. To facilitate this, Simplifai offers tailored solutions for the same, thus providing business values such as superior service, cost reduction, and overall growth.

Visit our web pages on Claims Handling, Customer Service, Document Handling, and InsuranceGPT for more information. Our AI Automation Platform ensures easy access, quick configuration, and manageability, enabling seamless integration with existing systems for end-to-end automation.