AI Automation in Front Office: Transforming the Way Banks and Financial Institutions Serve Customers

The aggregate potential cost savings for banks from AI is estimated at $447 billion by 2023, with the front and middle office accounting for $416 billion of that total, as per Autonomous Next research.

Banks are pursuing various digital transformation strategies with respect to how customers adopt rapidly transforming technologies. To provide them with the best services and convenience, banks digitize their operations in a competitive banking environment. The aggregate potential cost savings for banks from AI is estimated at $447 billion by 2023, with the front and middle office accounting for $416 billion of that total, as per Autonomous Next research.

Front-office in banking and finance is a critical area where customers directly interact with organizations for payments, deposit checks, queries, disputes and to gain information about other financial products with the services. Front-office uses a lot of data to make the most accurate decisions possible, but it’s also a place where repetitive tasks are performed.

That’s where AI comes in—the use of artificial intelligence to automate tasks like these can help reduce costs and increase efficiency so that front-office can focus on what it does best: making your organizations better by providing with the best possible customer service with AI solutions.

Inducing Intelligence in every banking “office” — front, middle and back

Imagine, the days you had to visit banks to enquire about loans, account disputes, and other activities related to account servicing. Contrary to today, this shows how innovations have altered our banking routines.

Tedious paperwork and long wait times when applying for credit cards or loans has now become a thing of the past. Thanks to AI, the entire process has become a lot more streamlined and hassle-free. Now, with just a few clicks, you can submit your application and receive a response in a matter of minutes. And that’s not all, AI can also help you find the best possible loan or credit card options for your specific needs. By analysing your financial data and personal preferences, AI algorithms can suggest the most suitable options for you, considering factors such as interest rates, repayment terms, and rewards programs.

Overall, AI has revolutionized the way we apply for credit cards and loans, making the process faster, more efficient, and more personalized than ever before. So, the next time you need a loan or credit card, don’t be intimidated by the process – trust in the power of AI to help you get the best possible outcome.

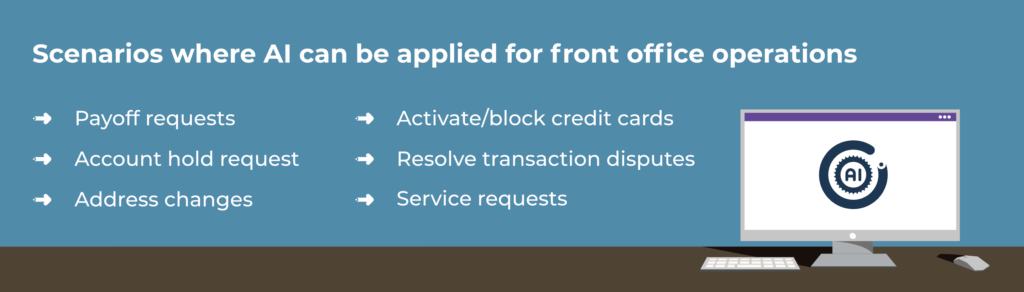

Front office operations can be revamped with AI in banking and finance

Primarily, the front office is responsible for delivering top-quality customer service. This is crucial for building customer loyalty and trust, which are essential for any financial institution that hopes to succeed in the long run. Also, the staff must be highly skilled in communication, problem-solving, and conflict resolution to provide the best possible experience for customers.

However, despite being a critical vertical that drives revenue generation for the organization, the response time and the level of customer satisfaction is one of the key challenges that arise due to slow and manual processes. Chatbots have taken over the responsibility of prompt customer interactions and they have done a commendable job. However, once chatbot takes the input, it processes queries to next stage, where customer expects to get the resolution. This is where solutions like Emailbot or Documentbot fill the gap alongside chatbots, offering a holistic AI automation solution for front office dedicated to Banking and Finance organization.

The use of AI in front-office for banking and finance can improve customer service by providing 24/7 support, personalized recommendations, and faster response times. It can also help financial institutions to reduce costs and improve efficiency.

Example of AI in banking

One of the second largest bank in Norway with a customer base of over 3 Lakhs has deployed an AI solution to automate a mass volume of 300,000 emails a year.

Let AI handle your banking operations

Learn how SpareBank 2 SR-Bank intends to achieve more than 350% Of ROI with AI automation.

Deploying new age technologies such as AI can yield immense benefits for organizations. However, it’s critical to deploy them in the right manner to maximize their potential benefits. For banks, this means considering some key imperatives.

Crucial imperatives to consider before deploying the AI in front office for Banking and Financial operations

To identify the right processes to automate

Blanket automation can be a costly error for financial institutions. Banks must identify the processes that will have the most impact from the automation exercise to yield the expected ROI.

To obtain management buy-in

Implementing any innovative technology requires buy-in from key stakeholder and leaders across the organization, especially top management. Establishing a Centre of Excellence (CoE) team is also crucial for deploying the technology across the organization.

Upgrading legacy systems

It is another imperative for banks to successfully deploy and benefit from intelligent operations. Intelligent operations entail the use of advanced technologies such as AI. Layering these technologies on legacy systems will not allow banks to realize the true benefits of the implementation.

Selecting the right partner

Banks must establish their objectives and areas to automate and pick a supplier who is strong in that particular area. Factors to consider include geographic location, quality of technical support, past implementation record of project deliveries, customer references, and cost of implementation.

Data security and privacy compliance is more critical.

Automation of banking processes involves customer data, and any action that impacts customer data must be reviewed carefully to comply with current and upcoming regulations. Any misreporting or manipulation of customer data can lead to regulatory action.

In conclusion, organizations need to cautiously tick the factors to deploy AI in front office for Banking and Financial operations. By doing so, they can maximize the potential benefits of these new age technologies.

Sources: Business Insider India