Drive efficiency Profitability Scalability

Transforming Insurance Companies across the globe to become future ready with our state-of-art AI solutions.

We deliver business value

Are you equipped to meet the demands of your customers that constantly change?

At Simplifai, we empower businesses to scale with innovation, ensuring they stay ahead of the competition. With our best-in-class compliance solutions, you can build a secure process that surpasses industry standards. Our cutting-edge technology helps exceed the anticipations of your customers and nurture a contented and productive workforce, driving your organization towards unparalleled success.

Build an efficient and secure process with Simplifai

Scale with innovation

Best-in-class Compliance

Rise above customer expectation

Foster workforce satisfaction

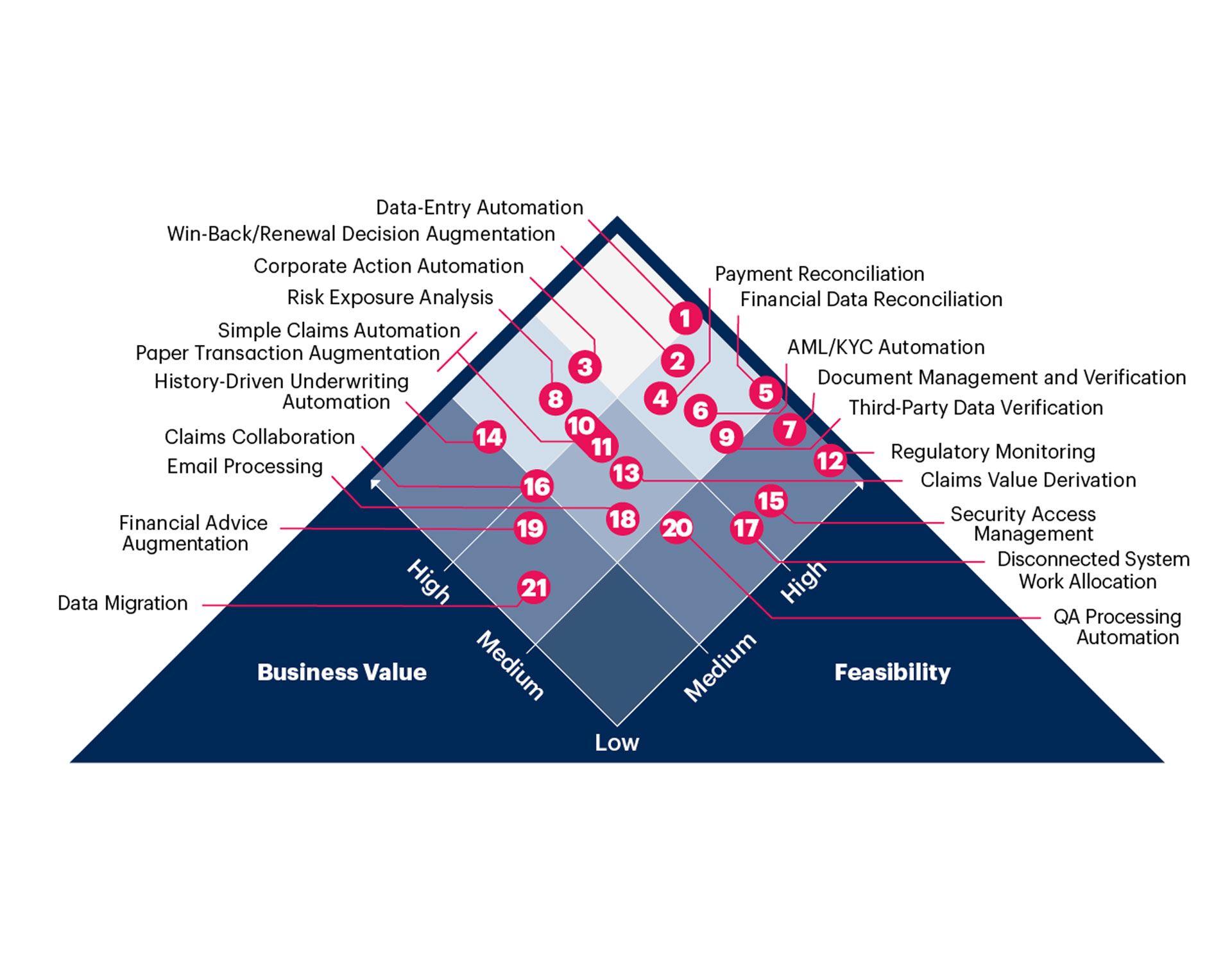

Hyper-automation use case

prism for Insurance[1]

We have helped several Insurance organizations in adopting digital capabilities

- Data-Entry Automation

- History-Driven Underwriting

- Claims collaboration

- E-mail processing

- Payment Reconciliation

- AML / KYC Automation

Source: Gartner, Hyperautomation Use-Case Prism for Insurance 2022, Laurie Shotton, Nicole Sturgill, 9 May 2022

Drive digital transformation with AI

Business leaders choose Simplifai to stay competitive with value-driven AI solutions.

Drive digital transformation with AI

Business leaders choose Simplifai to stay competitive with value-driven AI solutions.

- How to optimize IT expenditure while delivering business value?

- How can AI streamline workflows while ensuring compliance?

- How to stay ahead of industry trends and gain a competitive edge?

Scale your business with Simplifai

Simplifai helps decision-makers address the most concerning aspects of their business.

Scale your business with Simplifai

Simplifai helps decision-makers address the most concerning aspects of their business.

- How to ensure uninterrupted service delivery to meet performance goals?

- How to leverage AI to generate insights for enhanced business predictability?

- How to ensure a low-cost scalability with uncompromised customer experience?

Achieve seamless customer experience

Simplifai helps businesses in staying relevant to changing needs of customers with state-of-art AI solutions.

Achieve seamless customer experience

Simplifai helps businesses in staying relevant to changing needs of customers with state-of-art AI solutions.

- How to leverage AI automation to create a unique customer experience?

- How to enhance my customer service without increasing the budget?

- How to optimize the everyday work process for increased productivity?

Achieve business excellence with compliance

Simplifai empowers businesses with best-in-class AI solutions to focus on driving growth and innovation.

Achieve business excellence with compliance

Simplifai empowers businesses with best-in-class AI solutions to focus on driving growth and innovation.

- How to optimize business performance securely?

- How can AI streamline workflows while ensuring compliance?

- What should you implement today to accelerate predictable future growth?

Reduce churn and increase efficiency

Simplifai helps business leaders overcome day-to-day operational challenges for maximized productivity.

Reduce churn and increase efficiency

Simplifai helps business leaders overcome day-to-day operational challenges for maximized productivity.

- How to reduce staff turnover and increase workforce satisfaction with AI?

- How to bring the response time from days to a few minutes with high accuracy?

- How to handle documents efficiently to increase client satisfaction?

Empower your team with AI

Partner with Simplifai to enhance employee productivity and balance increasing workload with high-quality service.

Empower your team with AI

Partner with Simplifai to enhance employee productivity and balance increasing workload with high-quality service.

- How to optimize workflow to handle the sudden increase in workload?

- How to get rid of time-consuming manual processes for a stable workforce?

- How to deliver high-quality service with reduced errors and increased consistency?

Harness the power of AI with end-to-end automation technologies

Claims Handling

Claims inquiries consume employee capacity and effort. Accelerate the claims handling workflow with higher process accuracy and efficiency without upstaffing with AI.

Document Processing

Despite digitalization many customer transactions still require a vast number of documents. Our solution can process all customer documents securely and archive them for future reference.

Written Inquiry

Organizations receive thousands of written inquiries daily through email etc, which often requiring 7-14 mins processing time each. Our solution can lower the time to seconds, freeing the team to address complex cases.

We are your strategic AI partner

Simplifai empowers business leaders with advanced text-based Intelligent Process Automation. We revolutionize the way businesses handle written communication with our cutting-edge Natural Language Technology resulting in streamlined operations.

Simplifai InsuranceGPT

Harness the power of Generative AI by adopting InsuranceGPT for your business. Simplifai Insurance GPT is custom-built GPT program, fueled by the revolutionary no-code AI-powered platform. Being a first-of-a-kind custom, cloud-based, secure private Software-as-a-Service LLM-trained GPT solution can transform the insurance industry.

Join the Simplifai Reference Programme for advanced AI powered by GPT today.

- Performance oriented- Ensure quick, concise, and accurate responses in line with customer requirements.

- Integrate with existing ecosystems – Platform based, plugs into third-party services and industry platforms for claims management.

- Vigilant and Security compliant – Maintain control of all major laws and regulations to protect customer data.

- Streamline operations without coding –Simplifai no-coding AI Automation Platform for easy implementation.

Out of the box integration with your existing systems

Ready to future-proof your insurance business with Generative AI? ?

As Generative AI continues to reshape the insurance industry, staying informed and agile is paramount. This e-Book serves as an essential resource for insurance professionals seeking to navigate this shift successfully. Download the e-Book and take the first step towards a future-ready business!

80% of all customer inquiries handled automatically

Don’t let inefficiency and high costs undermine your claims management process. At Claims Link, a leading Norwegian independent claims settlement firm, they’ve mastered the art of efficiency. By automating 80% of all customer inquiries, they’ve not only revolutionized the customer experience but also unlocked a new level of operational scalability. The goals achieved by Claims Link were:

- Increased customer experience and efficient claims management

- Business scalability at lower cost

- Secure business operations when scaling

How? You’ll want to read this.

We adhere to the best-in-class data privacy and security protocols

We offer state-of-the-art, GDPR and ISO/IEC 27001:2013 compliant AI solutions. We respect user’s privacy and prioritize data protection right from design to development following the Secured Software Development Cycle (SSDLC) approach. Our transparent, enterprise-ready AI solutions empower customers with data control and clear usage purposes.

Want to know more about our compliance commitment?

Customers feedback

The AI solution from Simplifai will be the next step for us through its capability to read and interpret unstructured ‘free’ text in emails and several other formats of documents where RPA has limitations.

With the help of Digital Employees, Nh1816 Verzekeringen can organize the claims process more intelligently allowing employees to spend less time manually processing documents and e-mails.

I must admit that I’m positively surprised by the results. It was delivered as promised (and more) in a very short amount of time. The goal was to achieve a 70% automation grade, and we achieved way more.

Subscribe for latest news and updates

Gartner, Hyperautomation Use-Case Prism for Insurance 2022, Laurie Shotton, Nicole Sturgill, 9 May 2022

Gartner does not endorse any vendor, product, or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designations. Gartner’s research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.