AI in debt collection for happier employees and increased customer trust

Understand more about achieving a high-powered and AI-based superior customer experience.

Let’s imagine a scenario in the customer service department of a debt collection agency.

A group of people are working overtime to keep up with processing the ever-increasing workload of debt invoices generated for their customers. An agitated customer care employee is talking with a debtor who has not transferred the repayment on time. And the department’s head is spending hours long forming strategies that can nurture customer trust through unbiased payment offerings and repayment plans to keep the customers happy.

Sounds familiar? It surely is for debt collection agencies whose operations comprise such repetitive tasks that deny both employees and customers, the path of least resistance to their goals.

As a business leader in the industry, you might relate to this scenario, and be aware that these challenges affect the day-to-day working and bring in a horde of problems over the long term. And as a prime stakeholder, you would surely want to mitigate this situation.

Fortunately, there’s a way, and that’s via choosing AI-based business automation solutions. By adopting AI solutions, the above time-consuming, manual, and frustrating tasks can all be streamlined with ease. The AI can be trained accordingly to handle specific tasks and carry out important business actions.

Scroll down below to understand more about achieving a high-powered and AI-based superior customer experience.

Why is it getting more difficult for debt collection agencies to meet their goals?

Debt collection is a vital pillar in the money lending sector and is now at the forefront of this industry as it carries a promise of bringing growth and prosperity. Rising consumerism is promoting is creating vast opportunities for lenders to grow their business. However, it’s true that debt collection has been witnessing tighter margins and difficulties in reaching out to customers. This makes it important for organizations that deploy debt collection activities to understand customers’ situations and carefully analyse data to identify those who have the capacity to pay on time and those who cannot.

Debt collection agencies usually operate with the following objectives:

- To make the customer experience smoother

- To facilitate quicker settlements

- To nurture customer trust

- To maintain impartiality in repayments

To achieve these objectives, the agencies usually require the collectors to i) proactively reach out to the customers using data available for repayments at the front end, ii) spent time on administrative tasks such as processing documentation, research and reports, and archiving information at the back end. These tasks being inherently time-consuming in nature often also require the deployment of multiple resources in the form of employees, their remunerations, calling expenses, and physical mediums to store information.

Enhance your debt collection processes

Are you suffering from long tedious manual tasks in debt collection practices? Check out how AI-based automation can help your business free up time for your employees and improve process efficiency.

Managing debt recovery better with improved efficiency by using AI

With Artificial Intelligence, the above-described challenges can be mitigated in a streamlined way and uncover quality insights about customers which can be used to further drive improvements and achieve the core objectives.

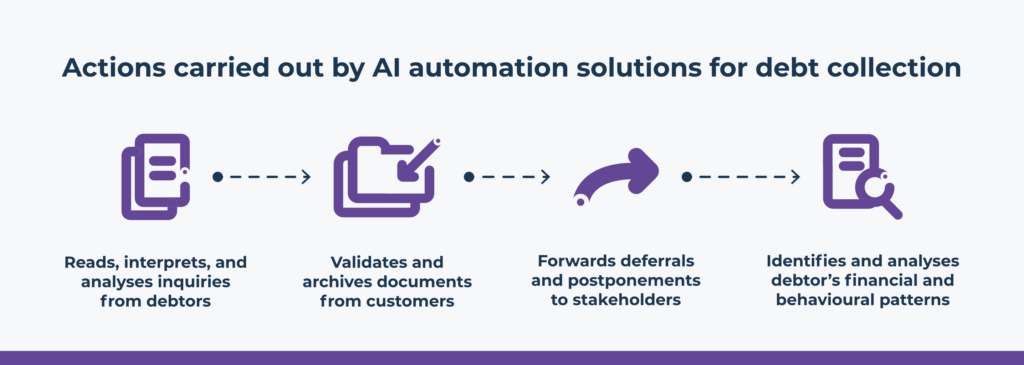

AI-powered business automation solutions can carry out numerous actions at both the front and back end of the agencies.

At the back end, they can read, interpret, and analyze inquiries related to invoices, postponements, objections, outstanding debt, receipt of payments, change of address, etc. The AI can further validate and archive documents containing customer information, account statements, and credit reports. Automating these tasks can speed up processes and the accuracy level significantly, thus boosting confidence among the employees and making them happier. At the back end, the AI mainly uses data derived from income, credit scores, and net worth to undertake specific business decisions.

At the front end, AI can detect the requirements and facilitate sending of the repayment postponement notices and deferrals to customers. An advantage of AI here is its capability to identify and analyze patterns in debtors’ financial behavior, which can help agencies personalize communications with selective customers. AI can also exist as virtual customer assistant channels to handle simpler customer cases and forward the more sensitive ones to humans. Thus, employees can save their own time as well as that of the customers and get things done faster with increased productivity.

AI automation business values & benefits for debt collection

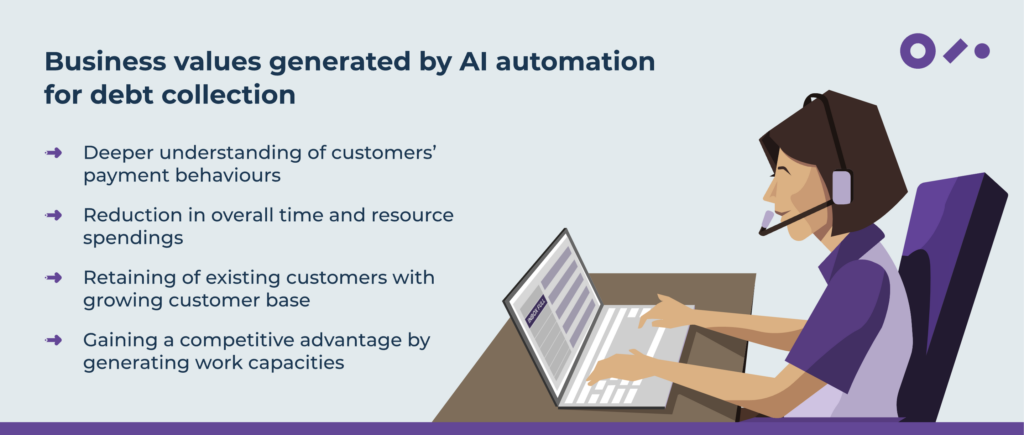

From an overall perspective, automation can help a business follow the best practices in debt collection and boost not processes on the operational side but also improve human decision-making. Debt collection organizations can also benefit on other fronts such as reduction of legal complexities from defaulter cases, decrease in financial liabilities by increasing productivity, and prevention of calls from being made too often that could increase stress and worry in customers.

In addition, agencies can get a better understanding of customers’ payment behaviors and identify potential defaulters. The reduced time along with resource investments can be utilized in other arenas that might need more focus for growth, thus gaining a competitive work advantage by creating more work capacities. With fewer numbers of calls and fewer communications, customers will trust such organizations more, thus leading to a growing customer base coupled with retaining existing customers.

Conclusion

It is vital to lay rest to the fear that AI automation could replace debt collectors’ work, and this is not true. AI automation solutions can be simply used as a way of improving collectors’ performance and productivity. Rather, due to the inherent nature of this industry, many cases will still need human intervention, and AI and humans can work in an augmented manner in cases such as complex negotiations situational analysis, and a need for human dialogue during high debt value repayment scenarios. Thus, taking a customer-first approach that uses AI to not only predict trends and assist consumers but also use data in a secure and compliant manner to provide insights that can lead to the personalization of services.

Read more:

A 5-point CIO plan for implementing AI-based automation in daily work operations

How to build an AI-based Ecosystem for business process automation