How to succeed in the age of AI Insurance: Transforming the Future of Work Today

These digital-first insurers are transforming the industry with their forward-thinking approaches and tech-savvy solutions. The…

The insurance industry, being both vast and ancient, has made a significant impact on nearly every individual’s life. Over the last decade, technological advancements have redefined the boundaries of possibility, paving the way for a new era of insurance companies. These digital-first insurers are transforming the industry with their forward-thinking approaches and tech-savvy solutions.

The strategic integration of technology, data analytics, and artificial intelligence (AI) along with intelligent automation in insurance has shaped a transformative change. It transforms the insurance sector from a traditionally policy-focused domain to one that is unequivocally centred around the customer. This powerful incorporation is reshaping the industry, establishing new paradigms of service and engagement that prioritize the needs and experiences of the insured.

Here’s a closer look at how this technological shift is reshaping the landscape.

Revolutionizing Insurance with AI: Enhancing Efficiency and Customer-Centricity

By harnessing the power of AI, the insurance industry is not only optimizing its internal processes but also delivering a higher standard of service to its customers, ensuring transparency, efficiency, and trustworthiness in all interactions.

1. Automation of Repetitive Tasks:

Many routine operations in insurance involve repetitive and time-consuming tasks such as data entry, document verification, and basic customer inquiries. AI-powered tools can automate these tasks, leading to faster completion times and reducing the risk of human error. AI can enhance the work efficiency by adding capacity to the existing team. It helps resolve complex tasks with increased effectiveness and productivity.

2. Enhanced Customer Service:

Virtual assistants and AI powered solutions can provide instant responses to customer inquiries, improving customer service and freeing up human agents to handle more complex issues. These AI systems can operate 24/7, ensuring that customer support is always available, which is particularly crucial in the insurance industry where timely responses can be critical.

3. Streamlined Workflow Management:

AI can optimize workflow management by intelligently assigning tasks to the most appropriate human agent or automated system, ensuring that work is completed efficiently. It also helps in identifying bottlenecks in operations and provides recommendations on how to streamline processes for better performance. Hence insurance automation can play a crucial role in streamlining the workflow management.

4. Accurate Data Management and Analysis:

AI systems excel at managing and analyzing large volumes of data. In the insurance industry, this capability ensures that customer data is handled accurately and securely. Through machine learning, these systems can derive insights from data to inform better decision-making and policy development. Along with it the privacy of the customer data remains intact within the sector. By adopting best-in-class AI compliant solutions, information and sensitive data can be protected.

5. Risk and Privacy concerns:

AI-powered solutions built on GDPR and ISO compliant software can protect the industry from all sorts of risks and privacy concerns. By adopting the secure AI solution company can safeguard the customer sensitive data through its state-of-the-art solution. Also by analysing historical data and identifying patterns, AI can help insurers to proactively manage risks. This includes predicting which policyholders are more likely to file a claim and taking preventive measures to mitigate potential issues.

6. Enhanced Decision Making:

AI supports improved decision-making through data-driven insights. This is particularly important in areas such as underwriting and claims assessment, where accurate information is crucial. Machine learning models can be trained to make recommendations, helping human agents to make informed decisions more quickly and more precisely.

7. Resource Optimization:

Through the automation of routine tasks and the optimization of workflows, AI empowers insurance companies to make the most efficient use of their human and financial resources. This strategic deployment ensures that these invaluable assets can be harnessed in the most effective manner possible. It allows human employees to focus on strategic, forward-looking endeavours while AI takes care of the repetitive and operational aspects of the business.

8. Continuous Learning and Improvement:

AI systems have the capability to learn from past operations and continuously improve over time. This means that the efficiency and accuracy of routine operations in the insurance industry will only increase as the system gains more experience and data to learn from.

Through these enhancements in routine operations, AI is playing a critical role in transforming the insurance industry, making it more efficient, customer-centric, and resilient to future challenges.

AI in insurance use-case

One of the Dutch insurance companies with history of over 200 years was looking for an AI powered solution that can resolve their challenges and help them to achieve following goals: –

- Scale work capacity by 10% every year without hiring new employees.

- Improve speed and availability to strengthen customer satisfaction.

- Absorb sudden volume upsurge and reduce the stress of short notice upstaffing.

- Upscale the work without upstaffing.

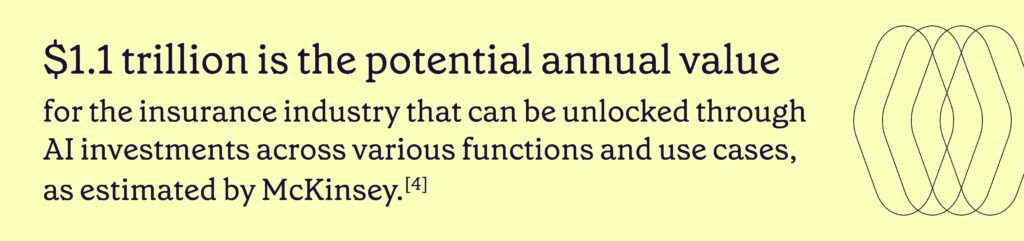

AI Adoption: The Imperative for Insurance Industry Survival

In this dynamic landscape, the insurance industry stands at a crossroads, where the adoption of AI isn’t just a choice, but a decisive factor that separates those who thrive from those who lag. The future of work is here today, and AI is at the forefront, reshaping how insurers operate and serve their customers. Those who have embraced AI are already reaping the benefits, optimizing processes, and ensuring a customer-centric approach. However, for those still on the fence, the risk of falling behind is real. In an industry where innovation and adaptability are key, the gap between early AI adopters and those who hesitate is widening. The message is clear: AI isn’t just an option; it’s the lifeline to staying competitive, relevant, and agile in the ever-evolving insurance landscape. The time to embrace AI is now; the future of your industry depends on it.

Source

- https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/insurance/insurance-pdfs/EY-claims-in-a-digital-era.pdf

- https://www.forbes.com/sites/forbestechcouncil/2023/04/17/harnessing-the-power-of-ai-in-the-insurance-sector/?sh=4169bf19335d

- https://www.ibm.com/blog/the-benefits-of-ai-in-healthcare/

- https://www.mckinsey.com/industries/financial-services/our-insights/insurance-2030-the-impact-of-ai-on-the-future-of-insurance