Beyond the Basics: AI’s Unutilized Power in Insurance Industry

Despite the potential for AI to drive significant improvements in efficiency, accuracy, and customer satisfaction, many insurance companies are yet to fully utilize its capabilities to achieve maximized return on investment (ROI).

With AI and automation expected to become a 190 billion industry by 2025[1], the pressure on insurers to stay relevant while continuing to scale grows with each passing year. In the insurance industry, the adoption of process automation is on the rise, transforming operations and enhancing efficiency across various domains. While automation of routine tasks and specific segments of the insurance value chain has become common, the comprehensive integration of Artificial Intelligence (AI) and cutting-edge tools remains underutilized.

Despite the potential for AI to drive significant improvements in efficiency, accuracy, and customer satisfaction, many insurance companies are yet to fully utilize its capabilities to achieve maximized return on investment (ROI). Currently, the application of AI in insurance tends to be fragmented, with only parts of processes being automated, leaving vast areas unexplored and untouched by this new age technology.

The potential of AI promises a major shift in how insurance companies operate, innovate, and engage with their customers. However, a significant gap exists between the current state of AI adoption and its potential impact on the industry. This blog aims to bridge that gap by shedding light on lesser-known or yet-to-be-identified use cases within insurance that can benefit immensely from AI and process automation.

AI Use Cases Beyond Mainstream Automation in Insurance

The journey toward full AI integration in insurance is filled with untapped potential and opportunities for innovation. While some areas of insurance have started to benefit from AI, including claims processing, underwriting, and customer service, there is a wealth of applications that remain largely unexplored.

Here are some use cases we have identified that span the entire insurance value chain of insurance operations, from customer engagement to policy management and compliance. Let us delve into how AI and process automation can transform these areas and the broader impact on the industry.

By delving into these untapped opportunities, we aim to illustrate how AI can not only streamline existing operations but also unlock new value propositions and competitive advantages for insurance companies.

Classifying Multichannel CRM Entries

Integrating AI into multichannel CRM entries involves classifying data into main categories, subcategories, and extracting relevant entities/metadata. This process enables a more organized and efficient handling of customer data, leading to improved response times and personalized customer service. AI-driven classification helps in identifying the nature of customer inquiries, such as technical support or billing questions, and directs them to the appropriate department. Additionally, by extracting key information like product names, issues, and customer sentiment, businesses can gain valuable insights into customer needs and preferences, allowing for more targeted and effective responses. This transforms the management of customer interactions by making the data handling process more streamlined and insightful, ultimately enhancing the overall customer experience.

Case Matching

AI can automatically match cases with the most relevant policies, guidelines, or legal requirements, ensuring that each case is handled according to the latest and most applicable standards. This enhances compliance, reduces human error, and improves the consistency of case outcomes.

Sales Assistance

AI-driven chat, emails, and webform automation can guide potential customers through the sales funnel, providing information on policies, answering FAQs, and even offering personalized recommendations based on user inputs. This can increase conversion rates and enhance the customer acquisition process.

Cancellations, Bonus Requests & Replies, and Wake-up Invoices

Automating these functions streamlines administrative tasks, reduces processing times, and minimizes errors. For cancellations, AI can swiftly process requests and identify opportunities to retain the customer. For bonus requests and wake-up invoices, AI can ensure timely and accurate handling, improving customer satisfaction and operational efficiency.

Renewal and Handling Payments Post-Cancellations

Automated systems can track policy renewal dates, sending reminders to customers and processing renewals efficiently. For payments post-cancellations, AI can keep a track of refunds or outstanding payments, ensuring financial transactions are handled accurately and swiftly.

Finding Relevant Treatment Information in Documents

AI can quickly sift through vast amounts of documentation to find specific treatment information, reducing search times and improving the accuracy of information retrieval. This is particularly useful in complex claims or underwriting processes.

Archiving Assistant

AI can automate the archiving process, categorizing and storing documents in an organized manner, making retrieval faster and more efficient. This not only saves time but also improves compliance with data retention policies.

Hub Integrations with Third Party Registers

AI can facilitate seamless integration with third-party registers, ensuring data is up-to-date and accurate across systems. This enhances operational efficiency, reduces data discrepancies, and improves decision-making processes.

The Comprehensive Impact of end-to-end Process Automation

Creating a Seamless Workflow

Automating the entire insurance value chain connects various stages of the insurance lifecycle, from customer onboarding, policy management, and claims processing to renewals and customer service. By automating these functions, insurers can create a seamless workflow that not only accelerates processes but also ensures consistency and accuracy throughout the customer journey. This integration eliminates manual handoffs and bottlenecks, optimizing operational efficiency and reducing costs.

Enhancing ROI

The impact of automation on ROI is multifaceted. Firstly, it significantly reduces operational costs by minimizing the need for manual intervention in routine tasks. This allows insurers to allocate their budget more effectively, investing in strategic areas that drive growth and innovation. Secondly, it enhances revenue opportunities by improving customer satisfaction through faster service delivery and personalized experiences, leading to higher retention rates, and attracting new customers. Additionally, the precision and efficiency offered by AI-driven processes reduce the risk of errors and fraud, further protecting the bottom line.

Mindful Utilization of Employees

One of the most significant advantages of process automation is the ability to reallocate employees to more strategic, high-value tasks. Instead of spending time on routine, administrative tasks, employees can focus on areas where human insight and expertise add the most value, such as developing new products, enhancing customer relationships, and strategic decision-making. This not only optimizes workforce productivity but also enhances job satisfaction by enabling employees to engage in more meaningful and impactful work.

Improving Data Insights and Decision Making

Automating the insurance process enhances data collection, integration, and analysis capabilities. AI algorithms can process and analyze vast amounts of data in real time, providing insurers with actionable insights that inform strategic decisions. This data-driven approach enables more accurate risk assessment, personalized customer experiences, and strategic market positioning.

Enhancing Compliance and Risk Management

Process automation improves compliance and risk management by ensuring that processes are consistent and in line with regulatory requirements. Automated systems can monitor and report on compliance issues in real-time, reducing the risk of violations. Additionally, the improved accuracy and traceability of automated processes enhance risk management, as insurers can quickly identify and address potential issues before they escalate.

A Call to Action for Insurance Leaders

The integration of Artificial Intelligence (AI) and process automation within the insurance industry signifies a strategic shift towards more efficient, customer-centric, and innovative operations. Automating the identified functions within the insurance industry paves the way for end-to-end automation, moving beyond piecemeal solutions to create a seamless, integrated operations. It is time for insurance leaders to take the helm, driving their organizations toward a future where AI is not just an operational tool but a strategic asset that can redefine the industry. Let us move beyond the status quo and fully embrace the power of AI in insurance.

References:

[1] Artificial Intelligence Market Size & Trends, Growth Analysis, Forecast [2030] (marketsandmarkets.com)

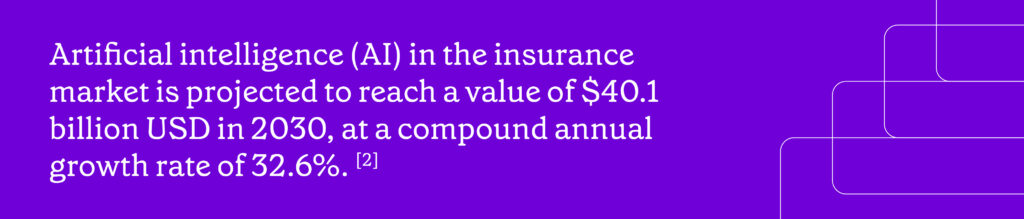

[2] AI in Insurance Market Size Share and Report Trends By 2030 (marketresearchfuture.com)

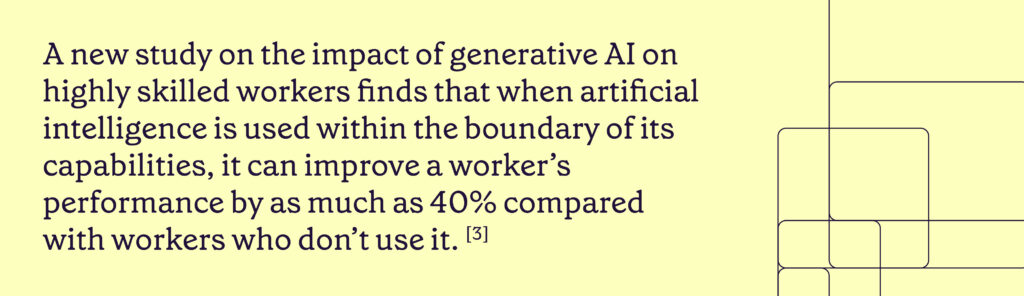

[3] How generative AI can boost highly skilled workers’ productivity | MIT Sloan

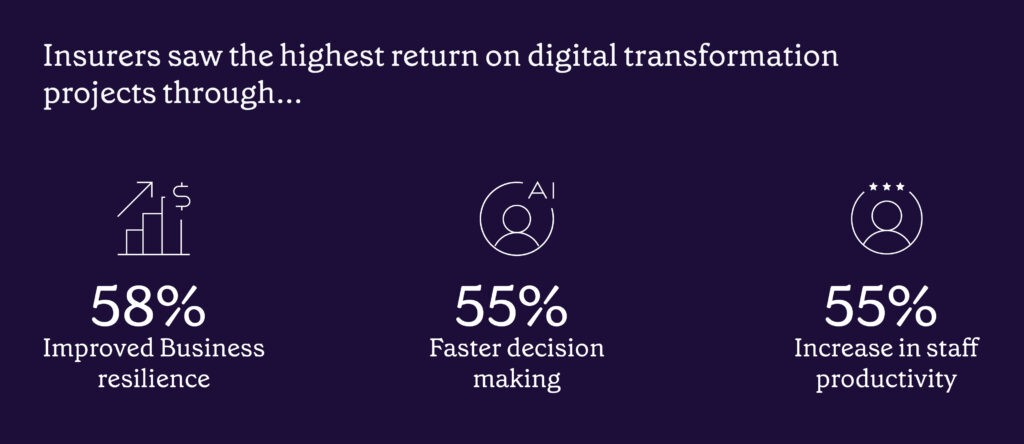

[4] Solera Innovation Index 2022 infographic (qapter.com)