AI in Banking: Beyond the Buzz to Real-time Benefits

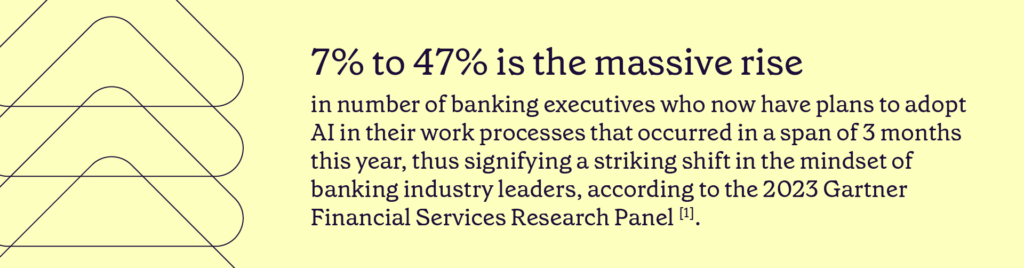

Today, the banking industry stands at a pivotal moment with technology disruptions and evolving consumer demands ushering in a growth curve. And contributing to this momentum are the rapid advancements in Artificial Intelligence; particularly with the recent rise in enthusiasm caused by Generative AI.

It’s true that Generative AI tools such as Dall-E, ChatGPT, Google Bard, and Midjourney, have managed to pique the interest of business leaders, while also making shifts from curiosity to open adoption.

This shows a dramatic change in the attitude of banking leaders towards AI in general as they take advantage of the value generation offered by the same. This leads to a key question – What steps should bank organizations take to keep up with the current AI trends and invest strategically in this technology to remain competitive in the future? This blog elaborates on some of the key considerations to keep in mind for business leaders and C-level executives in the Banking and Financial Services industries while considering investing in the potential of AI in banking and adopting it.

Choose the correct use case in your organization

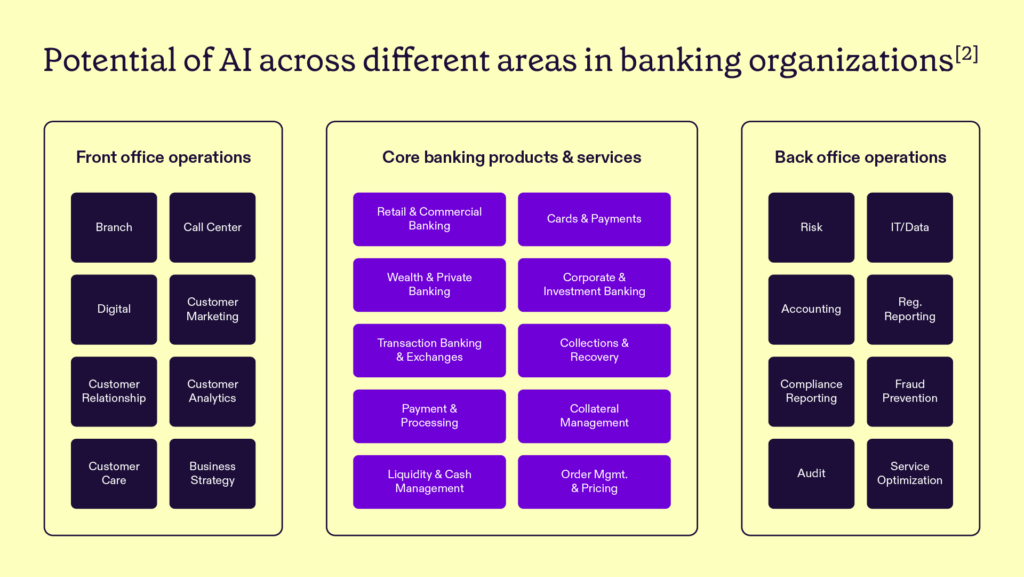

One of the key considerations or rather a way by which quicker and more accurate decisions regarding AI adoption in banking is via use cases. By focusing on which business function use case they want to use AI for, business executives in the industry can tailor deployments to specific circumstances, thus providing a good ROI.

Given below are some of the key use cases classified as per banking operations in three categories – Core, Front-office, and Back-office.

Core banking products and services – AI-driven cost optimization in Banking

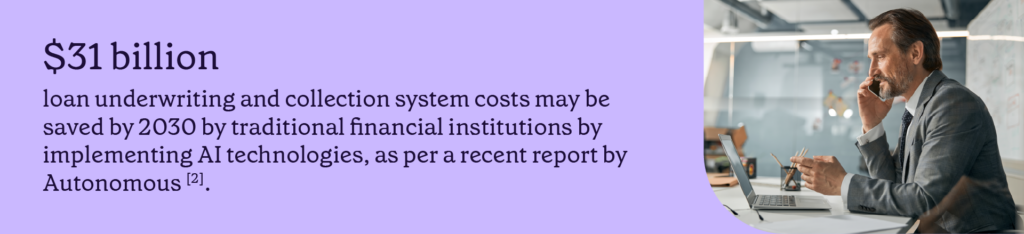

This is a game-changer in times such as the Covid-19 pandemic when several banking loan underwriting processes were affected. This process can be properly handled by AI-enhanced risk assessment to automate the gathering of customer inquiry data, assess the borrower’s risk, and make decisions regarding underwriting and loan disbursal.

A second area that tends to lean more toward financial services but nevertheless is related to banking involves the collection and recovery activities related to loans and debt. The rising cases of defaulters and various complexities in the recovery of debt may cause fiscal deficits for banks. However, AI-driven debt collection assistance can bring in efficiencies by offering customized payment solutions.

Front-Office – Maintaining a focus on customer experience and growth

In the front-office segment, providing the best customer experience often carries the highest priority from every bank.

Thus, more than 50% of customers in the banking industry now consider personalized services as a prime requirement, which helps them trust the organization. In fact, only 35% of traditional banks provide this personalization that meets customer demands [2].

Conversational chatbots and virtual assistants are quite useful for banks to provide a more human-like conversational touch while resolving inquiries. These provide round-the-clock information, help resolve actions related to bank account balances and other transactions, and provide instant replies to inquiries related to credit cards, debit cards, and loans [4].

Case Study Highlight – Bank of America Chatbot: Erica

In 2016, Bank of America introduced Erica, a pioneering chatbot that assists clients online. Erica offers notifications, money-saving advice, credit reports, and balance information. With 43% of online bank users preferring chatbots, Erica’s quick responses outpace her human counterparts. Gaining a million users in two months, Erica’s continuous interactions enhance her effectiveness, reflecting Bank of America’s successful investment in AI [6].

Back-Office – A need for streamlining the handling of rising customer case volumes

With accessible banking services and a growing global population, customer communication via calls, emails, chats, and messages is surging. Handling these inquiries, both front-end and back-end can become challenging. AI-powered solutions offer significant help, automating email, chat, and document-based interactions through end-to-end automation, delivering quick and accurate query resolution.

Another transformative AI application emerges in the back office, as AI can revolutionize compliance reporting’s regulatory and risk assessment activities, resulting in substantial cost savings by automating labor-intensive compliance processes and detecting regulatory changes.

Case study highlights: Wells Fargo adopts AI-powered Trifecta

Wells Fargo uses AI to improve its risk management operations. The bank has developed an AI-powered system called The Trifecta, which uses machine learning algorithms to analyze customer data and identify potential risks. This has improved the bank’s risk management capabilities and reduced the risk of default on loans and credit cards [7].

Key steps to follow while implementing AI in banking organizations

Like the growth of cloud platforms lately, organizations need to look past the buzz and focus on the tangible benefits and potential of AI in banking. Even though there are established instances of successful AI use, numerous banks view AI as a trial phase, with many pilot projects never reaching full deployment.

However, despite knowing about the business values generated through AI, they are still hesitant or don’t know the next step to take. Check below, where we highlight key areas spanning six steps where banks might need to refine their strategies for a triumphant AI integration journey.

Conclusion

The banking industry is undergoing a significant transformation, with Artificial Intelligence playing a central role in reshaping its future. And this is indeed true with various recent research such as a report by McKinsey that suggests the potential AI in banking and finance would grow as high as $1 trillion in the future [5]. As the landscape evolves, the key for banking leaders is to embrace AI not just as a trendy buzzword but as a strategic tool that can enhance every aspect of banking – from core products and services to front-office customer interactions and back-office operations.

By defining the right use cases, staying updated with current AI trends, and meticulously following the outlined steps for AI implementation, banks can not only improve efficiency and customer experience but also gain a competitive edge. As the numbers indicate, hesitance is dwindling, and the wave of AI adoption is ascending. To thrive in this new era, proactive adaptation, strategic investments, and informed decisions on AI integration will be crucial for success in the banking sector.

Sources:

[1] https://www.gartner.com/document/4439299?ref=TypeAheadSearch

[2] https://www2.deloitte.com/content/dam/Deloitte/us/Documents/process-and-operations/us-ai-transforming-future-of-banking.pdf

[3] https://www.forbes.com/sites/forbesbusinesscouncil/2023/03/20/the-future-of-ai-in-banking/?sh=267e6b915ed5

[4] https://www.zucisystems.com/blog/future-of-ai-and-machine-learning-in-banking/

[5] https://appinventiv.com/blog/ai-in-banking/

[6] https://medium.com/all-about-ai-media/top-3-use-cases-of-ai-in-banking-and-finance-aa4695d59842

[7] https://www.leewayhertz.com/ai-use-cases-in-banking-and-finance/